maryland digital ad tax bill

While some states and the District of Columbia have abandoned for now attempts to impose similar taxes several moresuch as Massachusetts New York Texas and West. The new tax had been approved by the states legislature in early 2020 but rather than signing HB 732 into law.

Governor Hogan Enacts Largest Tax Cut Package In State History Retirement Tax Elimination Act Becomes Law The Southern Maryland Chronicle

Digital advertising services Tax Alert Overview On February 12 2021 the Maryland Senate following the House of Delegates earlier in the week voted to override the veto of Governor Larry Hogan to House Bill 732 resulting in the enactment of a new gross revenues tax on digital advertising services in Maryland.

. On March 18 the Maryland General Assembly passed the first state gross revenue tax directed at digital advertising which is broadly defined to encompass any advertising appearing on a website mobile app or any similar digital platform House Bill 732. The succinct three-page bill which will be cross-filed in the House of Delegates by Majority Leader Eric G. May 11 2020 A bill that proposed a Maryland tax on digital advertising services that was approved by the state legislature in March was vetoed on May 7 by Maryland Gov.

House Bill 732 imposes a new tax on the gross revenues of a person derived from digital advertising services in Maryland. Specifically effective for tax years beginning on or after December 31 2020 a new tax would be imposed on annual gross revenues derived from digital advertising services in. Legislation is pending in Maryland Senate Bill 787 that revises tax laws enacted earlier this year when the General Assembly overrode vetoes of two 2020 bills.

One of the currently-enrolled proposals House Bill 732 was amended to include provisions previously included in standalone bills imposing a tax on digital advertising gross revenues. Maryland enacts new taxes on digital advertising and sales of digital goods. A person who derives gross revenues from digital advertising services in the state may not directly pass on.

This tax is the first of its kind. The legislations status remains uncertain due to an expected gubernatorial veto and potential. Larry Hogan R stopping at least for now the nations first tax on digital advertising.

By Jason R. Brown Kean Miller LLP New Orleans LA. The statutory references contained in this publication are not effective until March 14 2021.

House Bill 732. At that date the sales and use tax rate on a sale of a digital product or a digital code is 6. 732 2020 the Maryland Senate on February 12 2021 passed the nations.

Overriding the governors veto of HB. The Maryland Comptroller later released Business Tax Tip 29 Sales of Digital Products and Digital Code which took an expansive interpretation of the law and. On 12 February 2021 the Maryland legislature overrode Maryland Governor Larry Hogans veto of legislation HB 732 that imposes a new tax on digital advertising.

In his veto letter Hogan stated that the legislation would raise taxes and fees on Marylanders at a. The Maryland digital advertising taxapplied to gross revenue derived from digital advertising serviceshas a rate escalating from 25 percent to 10 percent of the advertising platforms assessable base based on their annual gross revenues from all sources ie not just digital advertising and not just in Maryland. For instance a company subject to the 10 rate having 100 million of revenue attributable to the performance of digital advertising services in Maryland would owe an annual tax of 10 million.

Importantly Senate Bill 787 would push the effective date of the tax on gross revenues from digital advertising services to tax years beginning after December 31 2021. The states new system will impose a gross receipts tax ranging from 25 to 10 on businesses with global revenues exceeding 100 million so. Digital advertising services includes advertisement services on a digital interface including advertisements in the form of banner advertising search engine advertising interstitial advertising and other comparable.

Wednesday March 17 2021. It is certain not to be the last. Effective March 14 2021 the Maryland sales and use tax applies to the sale or use of a digital product or a digital code.

The tax rate varied from 25 to. Luedtke D-Montgomery on Monday would also exempt broadcasters and news media from paying the tax. Maryland has become the first state in the nation to impose a tax on digital advertising services.

Currently the tax is effective for tax years beginning after. Instead of expanding the sales tax base to advertising services like DC below Maryland would have created an entirely new gross revenues tax on only digital advertising services display ads search engine ads mobile application ads and ads within a piece of software. The substance of the bill is a single sentence.

This is a completely new tax with its own tax return. Under House Bill 932 the 21 st Century Economy Sales Tax ActMarylands sales and use tax was expanded to digital products digital codes and streaming services effective March 14 2021.

Maryland Maryland North America Continent Historical Sites

The Fight Over Maryland S Digital Advertising Tax Part 1

Here S What The Infrastructure Bill Means For Maryland Conduit Street

Kirwan Blueprint Has Passed Now What Conduit Street

With Override Votes Md Senate Passes Landmark Education Reform And Digital Ad Tax Bills Into Law Wtop News

Exposed Get Your Walking Dead Reps To Take Action Online Branding Take Action House Party

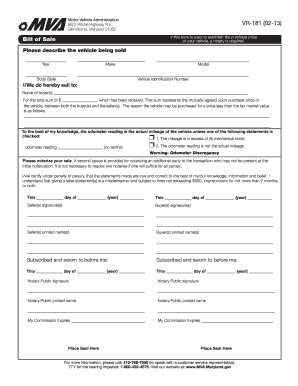

Get And Sign Mva Bill Of Sale Maryland 2013 2022 Form

Md Digital Advertising Tax Bill

Maryland Digital Advertising Tax Regulations Tax Foundation Comments

Maryland Digital Advertising Tax Regulations Tax Foundation Comments

Maryland Enacts Digital Products Sales Tax Exclusions Pwc

Maryland Amends Its Digital Advertising Gross Revenues Tax Creating Additional Constitutional Infirmities Salt Savvy

Winners Department Of Social Services Phd Student Services

Fully Automatic Fly Ash Brick Making Software Goods And Service Tax Billing Software Invoicing Software

Maryland Digital Advertising Tax Litigation Focus Moves To State Courts

Maryland Digital Advertising Tax Regulations Tax Foundation Comments